2025 Property Assessments

The Annual Notice of Assessment is informational and is not a tax bill. The notice informs the property owner of the current fair market value as calculated by the Board of Tax Assessors and the appraisal staff, as well as provides the property owner the assessed value (40 percent of the fair market value, by Georgia law) of their property.

The Board of Assessors is a separate and independent board from the Board of Commissioners and determines property assessments in accordance with Georgia law and the rules and regulations set forth by the Georgia Department of Revenue.

Important dates

- Real Property assessments were sent to property owners by mail beginning Tuesday, June 17th, and are available to view online.

- Personal Property assessments were sent to property owners by mail beginning Friday, June 27th.

- Property owners can appeal their property value as shown in the assessment notice for 45 days after the date of the notice.

Viewing Real Property assessments online

Residents are able to view 2025 property assessments online, review comparable properties and file an appeal digitally, if needed.

View your 2025 Annual Notice of Assessment online.

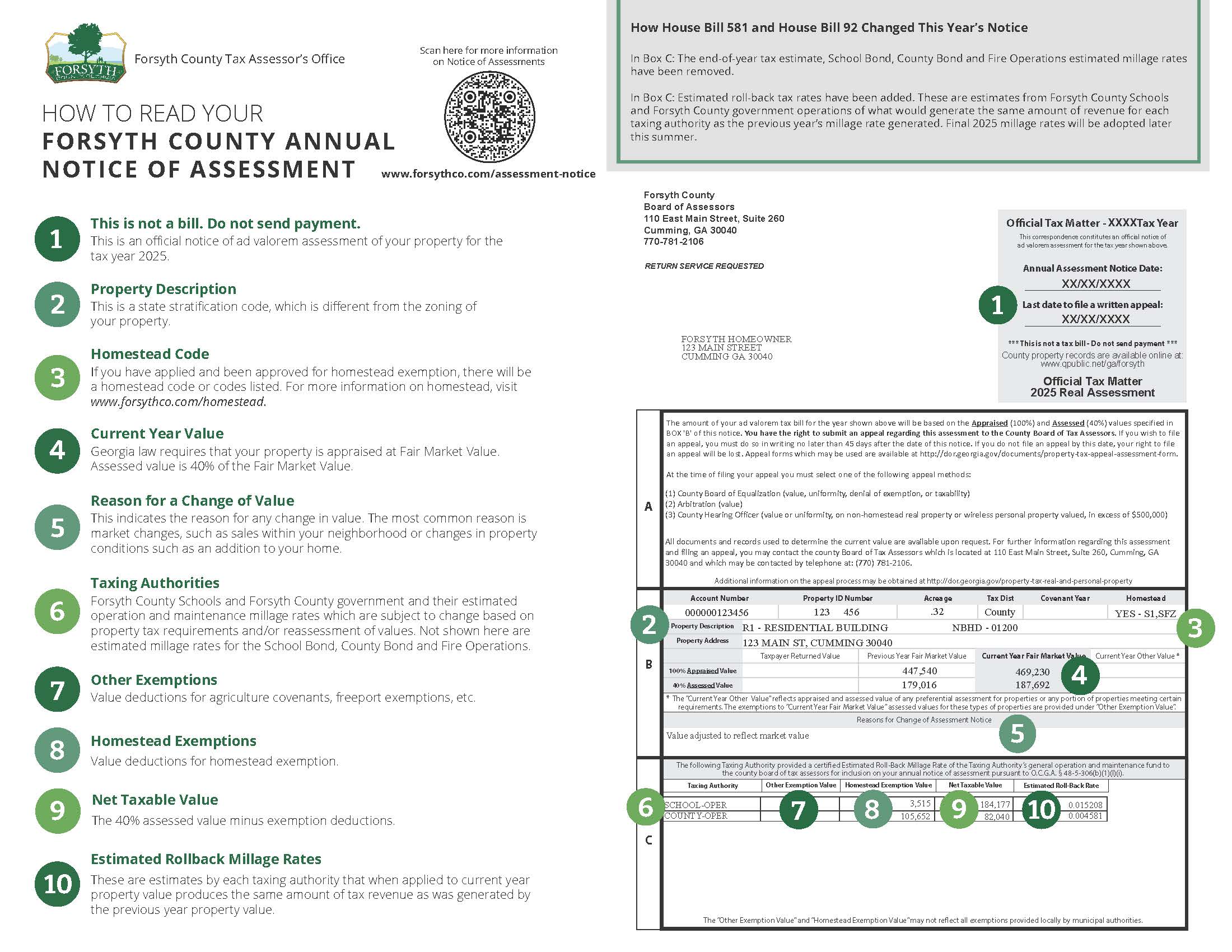

How House Bills 581 and 92 changed this year’s assessment notice

Recent legislation in Georgia, specifically House Bill 581 (HB 581) and House Bill 92 (HB 92), have introduced significant state-wide changes to Box C of the Annual Notice of Assessment.

- Removal of Property Tax Estimate and estimated millage rates for the School Bond, County Bond and Fire Operations. This information has been replaced by the current year’s Estimated Rollback Rate.

- Inclusion of Current Year Estimated Rollback Rates: these rates estimated by each local taxing authority (Forsyth County Schools and Forsyth County government operations), reflect the millage rate needed to generate the same revenue as the previous year from the existing property, excluding new construction or improvements. If the final adopted millage rate exceeds this estimate, property tax bills must include a disclaimer stating that taxes have been raised beyond the estimated rollback rate.

What is the aim of these changes? Under HB 581 and HB 92, the addition of rollback rate information to the annual assessment notice aims to provide property owners with greater visibility into how local governments determine property taxes and if property taxes are increasing and by how much.

How to Read Your Annual Notice of Assessment (PDF).

Click image to enlarge (PDF).

Appeal a property assessment

Property owners will have the opportunity to appeal their property value as shown in the assessment notice for 45 days after the date of the notice.

File online. Click here to file for an appeal online. You will be taken to a screen to search your property by name, address or parcel number. Once you have located your property, you will see the Online Appeal option. Users can also look at other comparable properties.

File in person. You can also file an appeal in person at the Board of Assessors Office located at 110 East Main Street, Suite 260, Cumming, GA 30040.

Property owners wishing to appeal their property value must submit the appeal in writing and should indicate which appeal process they elect to utilize.

The appeal process offers four different options for property owners:

- Board of Equalization (BOE): Appeal to the County BOE with appeal to the Superior Court.

- Arbitration: Appeal to arbitration with an appeal to the Superior Court (valuation is only grounds that may be appealed to arbitration). Fees may apply.

- Hearing Officer: For (1) nonhomestead real property (and contiguous real property) or (2) wireless personal property account(s) with a FMV in excess of $500,000 to a hearing officer with appeal to Superior Court (value and uniformity only).

- Superior Court: Appeal directly to the Superior Court (requires consent of Board of Assessors) (any/all grounds). Fees may apply.

Learn more about the appeal process options (PDF).

How property taxes are calculated

In late August, property owners will receive their property tax bill following the adoption of millage rates by both taxing authorities.

Forsyth County’s two separate taxing authorities, the Board of Commissioners (County government) and Board of Education (public school system) both set their property tax millage rates annually to determine the amount of property tax collected for each authority from real property owners in the County.

The adopted millage rates are calculated against each property’s assessed value to determine the total amount of property taxes billed.

Below are the adopted millage rates in 2024. Rates for 2025 will be advertised and adopted later this summer following a series of public hearings.

- County Maintenance & Operations (M&O) (4.791 mills)

- Fire Operations (2.505 mills)

- County Bond (0.600 mills)

- School Operations (15.208 mills)

- School Bond (1.418 mills)

Property taxes are calculated by the Forsyth County Tax Commissioner’s Office using this formula:

((Property Value x .40) – Eligible Exemptions) x Combined Millage Rates = Property Tax

Example (using 2024 millage rates):

| (($500,000 x .40) – eligible exemptions) x .004791 (County Operations)

|

= $958.20

|

| (($500,000 x .40) – eligible exemptions) x .000600 (County Bond)

|

= $120.00

|

(($500,000 x .40) – eligible exemptions) x .002505 (Fire Operations)

|

= $501.00

|

| (($500,000 x .40) – eligible exemptions) x .015208 (School Operations)

|

= $3,041.60

|

| (($500,000 x .40) – eligible exemptions) x .001418 (School Bond)

|

= $283.60

|

| *TOTAL

|

= $4,904.40

|

*Does not reflect any eligible exemptions (ex: Homestead Exemption)

Learn more about how property taxes are calculated and what they fund in Forsyth County.